General insurance market landscape – September 2021 premium pricing and outlook

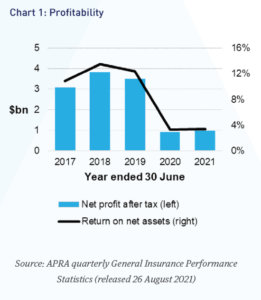

As your dedicated insurance representative, we’re constantly monitoring the insurance market to better understand and assess the trends with potential to affect your business. With this in mind, we wanted to share a summary of our updated market assessment on the factors currently impacting insurance pricing in Australia. The recently released APRA (Australian Prudential Regulation Authority) quarterly report shows relatively consistent industry profitability for the 12 months to June 2021. Industry profitability improved only marginally to $1B, up from $0.95B the year before for the same period.

As your dedicated insurance representative, we’re constantly monitoring the insurance market to better understand and assess the trends with potential to affect your business. With this in mind, we wanted to share a summary of our updated market assessment on the factors currently impacting insurance pricing in Australia. The recently released APRA (Australian Prudential Regulation Authority) quarterly report shows relatively consistent industry profitability for the 12 months to June 2021. Industry profitability improved only marginally to $1B, up from $0.95B the year before for the same period.

Pricing and capacity

The impact of flattening investment returns remains significant. We will continue to see capacity and product supply weakened, meaning premium rates will most likely continue to trend upwards. Whilst pricing has been the primary lever used by Insurers over the past 24 months, capacity is becoming an increasing concern, with some Insurers withdrawing from what were previously considered ‘vanilla’ risks. We anticipate cover for some industries and locations will remain unattainable until more profitable levels return. After a year of average increases (8-10% for Commercial and 15%+ for large Property assets), the APRA statistics indicate premiums will continue to rise in the vicinity of 8%-12% for the next 12 months.

Other market forces

Below are some of the other key factors impacting the insurance market.

Low interest rates

Historically low interest rates continue to place pressure on Insurers’ returns. Whilst interest rates and investment returns remain flat, claims reserves need to be ‘topped up’.

AU$

The AU$ has reduced from around US77cents (March 2021) to now hovering around US74cents (September 2021). This has seen the continuation of claims cost inflation remaining higher than the general ate of inflation across the Australian economy. The impact will be higher costs for materials or equipment imported as part of a claims settlement.

Looking to the future

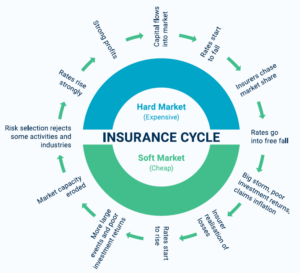

The insurance industry, we believe, is at 10 o’clock on the insurance clock. How long it remains there largely depends on the frequency and severity of future catastrophic events. It’s clear, without corrective action, the industry cannot sustain continual year-on-year catastrophic events whilst still providing cover for ‘usual’ loss events. We subsequently believe average premium increases will remain in the range of 8% – 12%. The exact figures will be influenced by industry sector, geographic location, prior claims experience and approach to risk management.

Structural change and cost cycles are part of every industry. The insurance clock is a useful tool to represent where insurance rates are right now and where they’re likely to be heading in the future.

With this hard market cycle, we anticipate:

✓ Period of higher premiums

✓ Period of higher premiums

✓ Getting insurance coverage could become more difficult and harder to negotiate terms

✓ Insurers reducing capacity with some risks or industry groups (e.g. recycling, financial services, directors/officers insurance)

✓ Higher excesses

✓ Focus on risk management and mitigation processes

✓ More time and additional information required to place insurance.

It’s crucial we continue to work together to maintain policy terms and conditions, even with prices on the increase. After all, as our experience consistently shows, price is ultimately forgotten when an insurable loss happens.

Property sums insured

The Insurance Council of Australia (ICA) estimates some 83% of properties are underinsured. This quote was prior to the pandemic, since then rebuilding costs have increased dramatically. Quantity surveyors now estimate costs to rebuild buildings has increased by more than 10%, across some areas of Australia, in just the last six months. This is due to construction times being extended and a result

of continuing material shortages and labour scarcity.

As your Advisers we believe property asset values need to be reviewed on a regular basis to ensure your adequately insured. Having incorrect insured value could see any claim been adjusted due to underinsurance.

Having a professional valuation will prevent this. As your Adviser I can arrange access to professional quantity surveyors that can accurately confirm building rebuild costs for both commercial and domestic buildings. Should you have any questions, or would like to arrange a valuation, please don’t hesitate to get in touch. We’ll be very happy to help.

Should you have any questions, or want to book a review, please don’t hesitate to get in touch. We’ll be very happy to help.

Get an insurance review or quote

We would be happy to discuss your needs, assess your current insurance solution and provide you with a quote. Just contact us here.

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Maple Insurance & Risk

Level 17, Angel Place

123 Pitt Street

Sydney NSW 2000

info@mapleinsurance.com.au

(02) 8329 0999

Site map

Maple Managed Risk Pty Ltd trading as Maple Insurance & Risk is a Corporate Authorised Representative of Insurance Advisernet Australia Pty Ltd. AFSL No. 240549.

Corporate Authorised Representative No. 1288279. Visit the Insurance Advisernet website.

Privacy | FSG | Disclaimer | Consumer Advice | Compliments & Complaints

Website by Businessary